How might we empower college students to build a proactive and flexible budgeting habit.

From preliminary interviews it was found that users wanted

- A safe and secure way to learn about finances

- To know it is never too early to start saving, and create a plan

- A more CLEAR and SIMPLE information about finances

- Easy usability and low barrier to entry

- Aesthetics MATTER and incentivize prolonged use

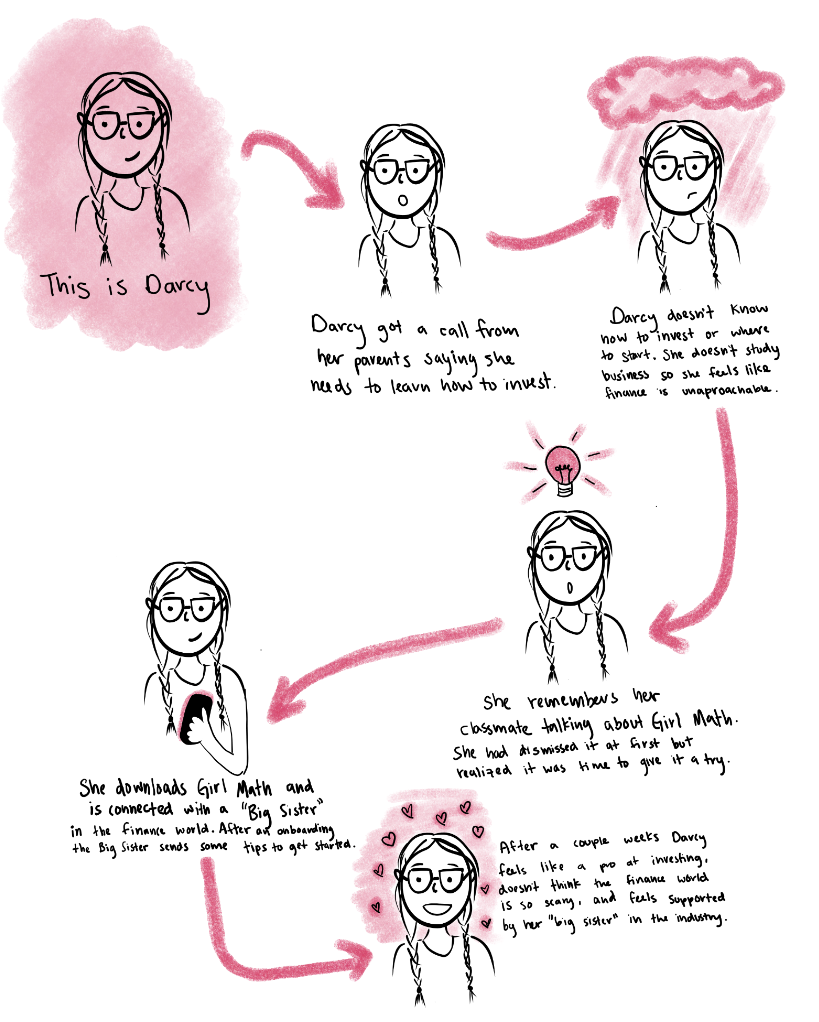

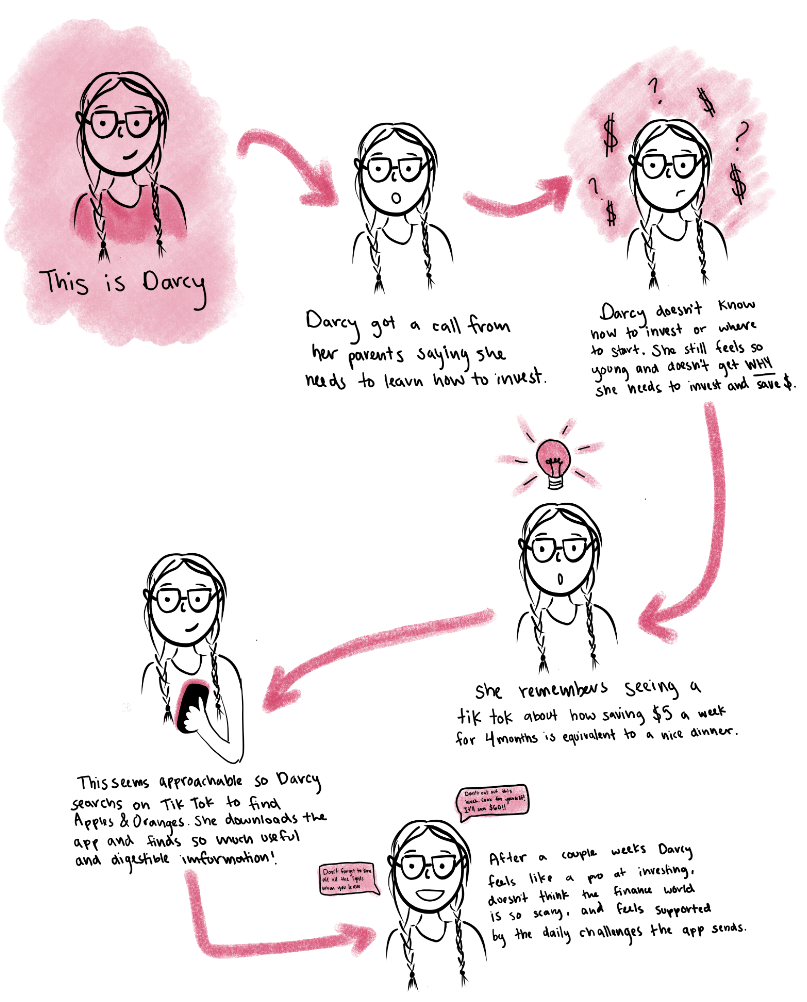

Using the information from the interviews I created a persona and storyboards that reflected these values.

General Storyboards - these ideas were eventually combined

To better understand the order of operations in successfuly setting up a budget we decided to sit down and go through the steps ourselves.

When completed we realized how important it is to do these calculations on your own. It seems necessary in order to truly understand where your money is going. Once you calculate the numbers yourself you feel more ownership of your budget and therefore more invested in staying on track

Together we decided our app would include:

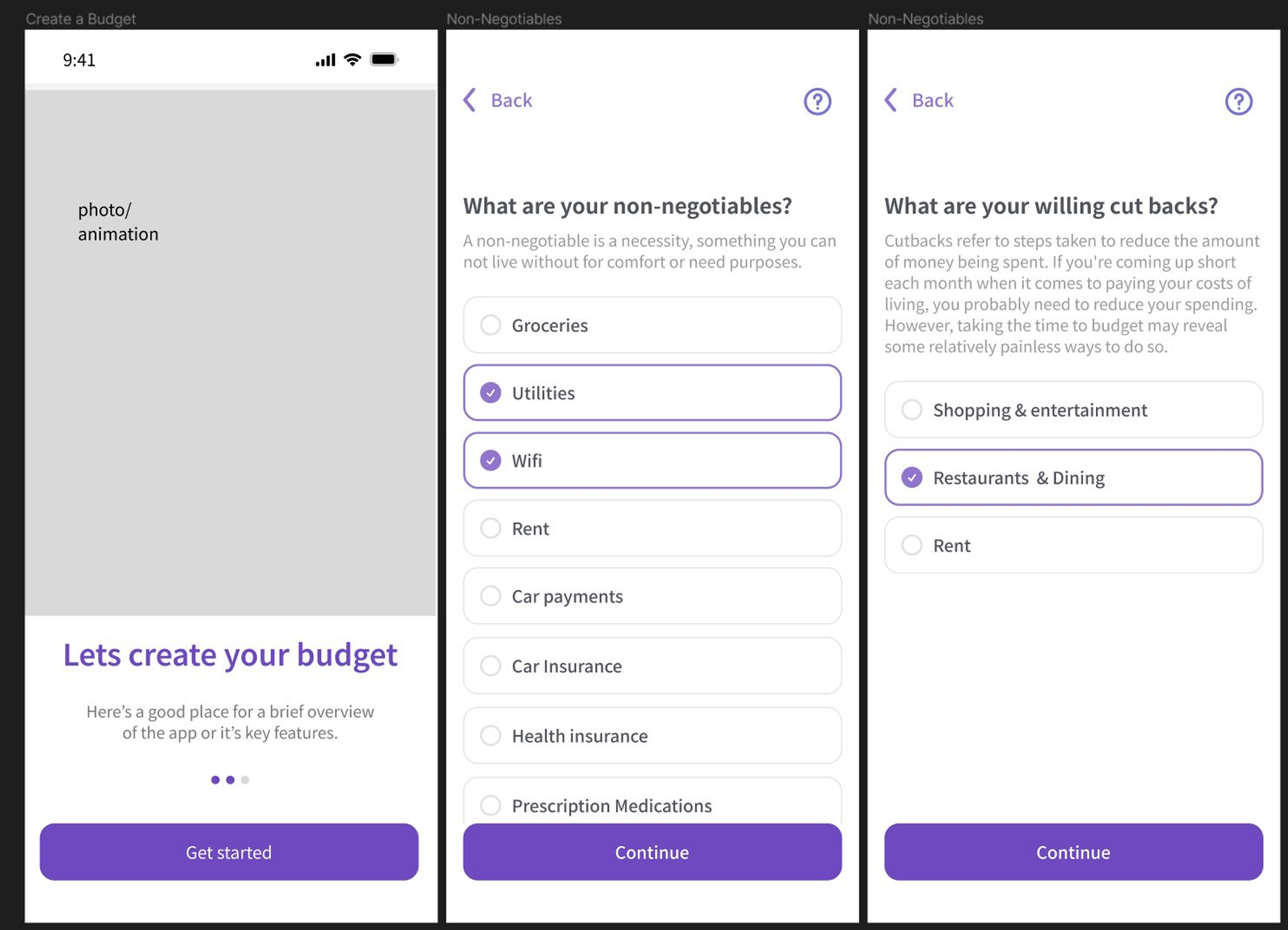

1. An educational and comprehensive onboarding process

2. Approachable budgeting

3. Challenges to keep users engaged beyond the first use

4. The ability to build good spending and saving habits

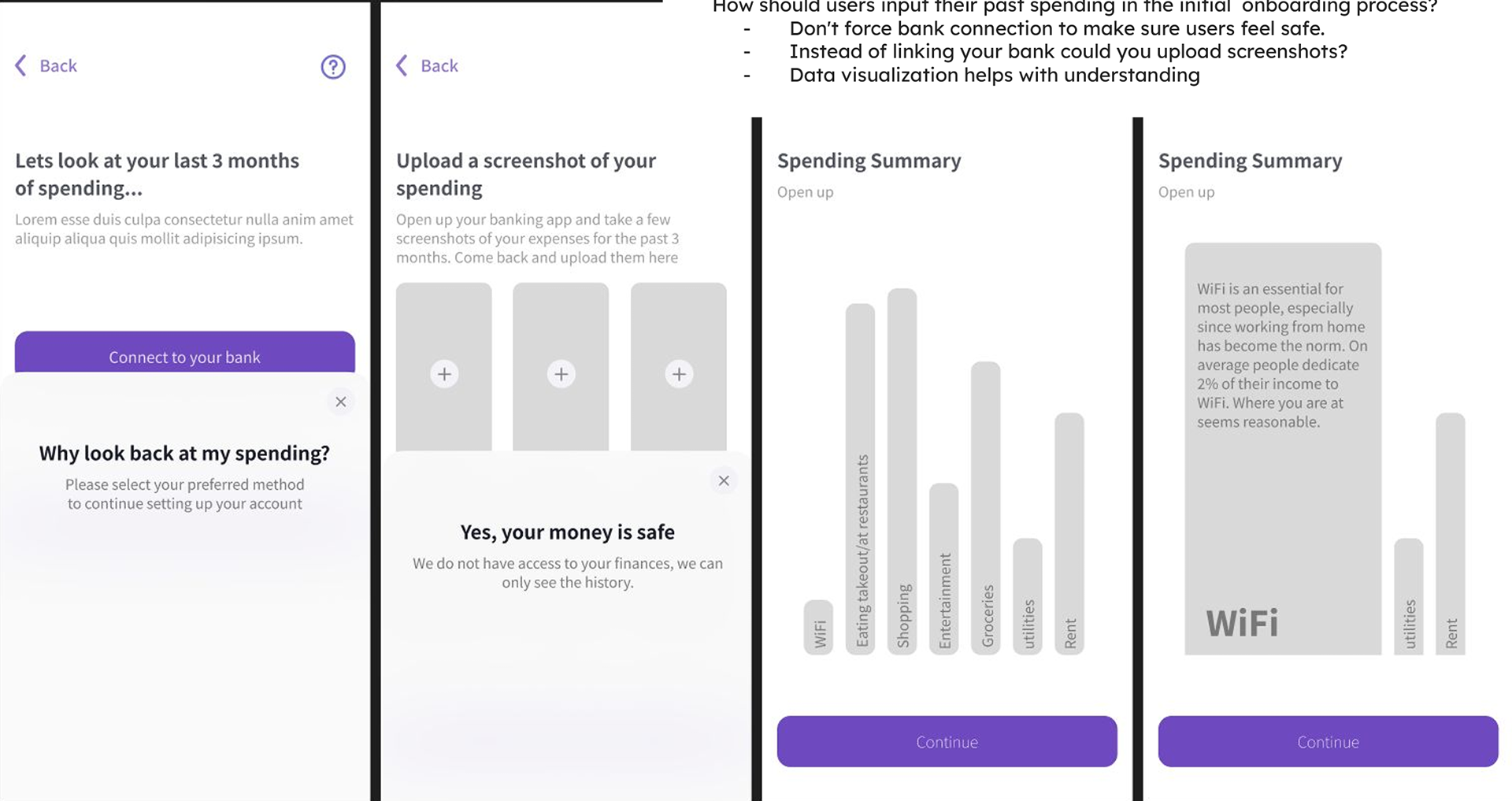

Based off of our preliminary information we began working on Low Fidelity wireframes using styles we developed.

User Testing

During the user testing session, several insights were gathered to improve the onboarding experience and overall user journey. Some users expressed a need for more flexibility during onboarding, noting that the given options didn’t always apply to their specific circumstances. They suggested that more customizable choices could enhance engagement. Button functionality was tested and found to be responsive, ensuring smooth navigation and a positive user experience. On the visual design front, there was a recommendation to switch the light grey to a pastel blue to maintain a pleasant aesthetic without creating much disruption. Another suggestion was to add a screen in the banking section to clarify that users are not required to add personal expenses if they choose not to, offering greater transparency. These insights were valuable in refining the platform to meet both functional and aesthetic needs.

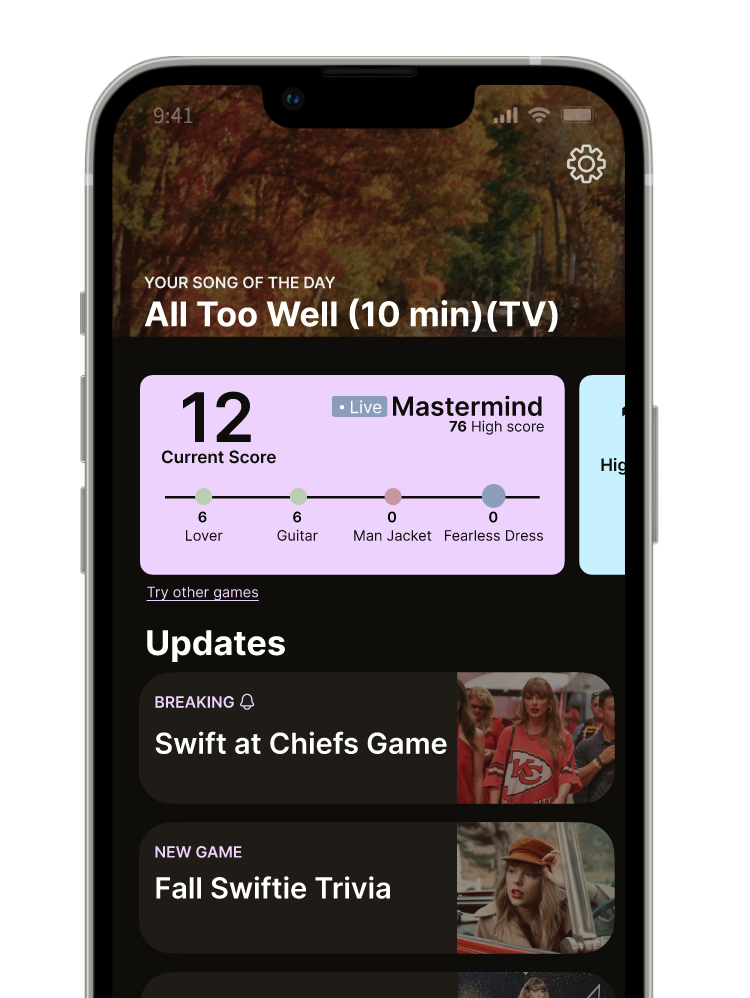

Final fifi Prototype

Fifi stands out from other apps with its unique Plan Ahead function, catering to the dynamic lifestyle of college students who often benefit from flexible budgeting. Whether you're at home during breaks, spending less and contributing more to savings, or navigating a busy December with birthdays and social events, Fifi empowers you to plan ahead for both short-term and long-term financial goals. Unlike apps focused on major life expenses, Fifi recognizes the importance of week-to-week planning, ensuring your funds stretch to meet weekend needs. It's not just about preparing for significant purchases like your first house; Fifi helps you cultivate the healthy habit of considering your finances before every spending decision. With Fifi, you can effortlessly stay on track, whether you're saving for the future or managing your budget on a weekly basis. Fifi helps young adults create healthy habits, so when the bigger purchases do come along you will have the skills necessary to get there.